HS code is an international harmonized product coding system. In the countries of the EAEU they use the Commodity Nomenclature of Foreign Economic Activity - the commodity nomenclature of the product.

HS編碼是國際統一的產品編碼系統。 在 EAEU 國家,使用 TN VED — 產品的商品命名法。

HS code is an internationally harmonized product coding system. In the EAEU countries, TN VED is used - the commodity nomenclature of a product product.

HS - the code stands for Harmonized System - a harmonized system for describing and coding goods.

Experts from the Soyuzconsult international network will provide analytics on markets, products and competitors. They will analyze the digital footprint of your product, determine and find customers abroad. Consultations are paid!!!

What is HS code? HS code is an international harmonized product coding system. The CIS uses the TN FEA (commodity nomenclature for foreign economic activity), which almost completely coincides with HS . HS codes are standard, internationally recognized codes that identify products for export and import purposes.

HS (Harmonized System) - a system for describing and coding goods (a standardized system for classifying goods in international trade; goods are classified both by purpose (clothing, weapons, etc.) and by economic sectors (textile products, animals and livestock products and etc.) Selected categories are assigned 6-digit codes

Commodity Nomenclature of Foreign Economic Activity is a classifier of goods used during customs operations by declarants and customs inspectors, therefore the rates of import and export duties depend on which Commodity Nomenclature of Foreign Economic Activity code the product belongs to.

Platform for exporters. We organize sales online, wholesale for export. We will present your product and find business partners, buyers, suppliers, investors around the world. Trade Union Souztrade.RU is a platform for exporters, we offer services to support foreign trade transactions.

Sets of HS code

Product codes, such as OKPD2 and TN VED are needed to classify products for further actions with them, customs clearance or certification; customs rates depend on these codes and what type of certificate is needed.

It happens that you can select different HS codes for the same product, and this will determine whether the importer will pay 20% taxes at customs or not. Attention: For the convenience of the user, on our official website sertiki.ru, we present not only all HS codes, but also examples of declarations (assigning different specific product items to HS codes) for 2021. For example: TN VED code for clothing or TN VED code for products.

So, let's start with the HS code tree, in which you can find the HS code manually and by search, view detailed information on this code (by clicking on the booklet in the tree), and also go to the customs declaration database, where you can select the HS code Foreign economic activity for your specific product using real examples, since there are a lot of types of products and not all of them are, of course, registered in the HS code tree, customs brokers are responsible for assigning HS codes to products, and even they cannot always determine the HS code for a specific product,

Through our service you can see which HS code corresponds specifically to your product using real examples; this data is selected from a huge database of customs declarations (1 million unique declarations).

In this database you can search both by code number and by product name . Good luck in finding!

| Tree | Search |

- 1 SECTION I. Live animals, products of animal origin

- 2 SECTION II. Products of plant origin

- 3 SECTION III. Fats and oils of animal or vegetable origin and their breakdown products, prepared edible fats, waxes of animal or vegetable origin

- 4 SECTION IV. Prepared foods, alcoholic and non-alcoholic drinks and vinegar, tobacco and its substitutes

- 5 SECTION V. Mineral products

- 6 SECTION VI. Products of chemical and related industries

- 7 SECTION VII. Plastics and products made from them, rubber, rubber and products made from them

- 8 SECTION VIII. Raw hides, dressed leather, natural fur and articles thereof, saddlery and harness, travel accessories, handbags and similar goods, articles made from animal intestines (except silkworm fiber)

- 9 SECTION IX. Wood and products made from it, charcoal, cork and products made from it, products made from straw, alfa or other wicker materials, baskets and other wicker products

- 10 SECTION X. Pulp of wood or other fibrous cellulosic materials, regenerated paper or cardboard (waste paper and waste), paper, cardboard and products made from them

- 11 SECTION XI. Textile materials and textile products

- 12 SECTION XII. Footwear, hats, umbrellas, sun umbrellas, walking sticks, seat sticks, riding crops, whips and parts thereof, processed feathers and articles thereof, artificial flowers, articles made of human hair

- 13 SECTION XIII. Articles of stone, plaster, cement, asbestos, mica or similar materials, ceramics, glass and glass articles

- 14 SECTION XIV. Natural or cultured pearls, precious or semi-precious stones, precious metals, metals clad with precious metals and products made from them, costume jewelry, coins

- 15 SECTION XV. Base metals and products made from them

- 16 SECTION XVI. Machines, equipment and mechanisms, electrical equipment, their parts, sound recording and sound reproducing equipment, equipment for recording and reproducing television images and sound, their parts and accessories

- 17 SECTION XVII. Land transport vehicles, aircraft, watercraft and transport-related devices and equipment

- 18 SECTION XVIII. Optical, photographic, cinematographic, measuring, control, precision, medical or surgical instruments and apparatus, watches of all kinds, musical instruments, their parts and accessories

- 19 SECTION XIX. Weapons and ammunition, their parts and accessories

- 20 SECTION XX. Miscellaneous industrial products

- 21 SECTION XXI. Artworks, collectibles and antiques

How to find out the HS code for document preparation: three ways

To assign a specific value, you should use the product nomenclature database approved by the decision of the EAEU Council. Within the current classification, there are 97 product groups, each of which has a three-level hierarchy. For organizations and private entrepreneurs facing this type of task for the first time, there are several options.

Self-study

Perhaps the most time-consuming and labor-intensive method, which, however, allows you to expand your own knowledge and improve your professional qualifications. In addition, it is free - all the documentation regulating what the HS code means, where it is indicated, and on what basis it is assigned is in the public domain. Materials recommended for review include:

- Rules for the interpretation of product nomenclature.

- List of explanations for the current codifier.

- Documents on decisions on identification of goods.

- Decision of the Council of the Economic Commission of the EAEU No. 54 of July 16, 2012.

The description procedure is implemented carefully and consistently - it is necessary to characterize the design of the product, its functionality and composition. You should start with general characteristics, gradually moving to specifics. To do this, you can use specialized online services that offer a keyword search option. However, it should be taken into account that in free versions, database updates are rarely carried out, so for full-fledged operation you will have to subscribe, which gives access to up-to-date information. And even in this case, the results offered by the system should be subjected to additional verification.

Engaging a customs broker

On the contrary, the simplest and fastest, but at the same time associated with financial costs, method of determining the item code. Professional consultants on HS usually provide results within a couple of hours, but if the intention to involve an outside specialist has already arisen, it will be easier and more practical to completely delegate the declaration procedure to an official representative.

Through contacting customs authorities

Another option is to submit an electronic application for a preliminary classification decision. The form is available on the State Services portal and is quite simple to fill out, but the stated period for providing the service is 90 days. In addition, the service operates on a paid basis and requires payment of a fee of 5,000 rubles.

SEA BANK (JSC) offers small, medium and large businesses to use the international corporate Visa Business card.

So what is the HS code?

TN VED is an abbreviation that stands for “commodity nomenclature for foreign economic activity.” At its core, it is a classifier for goods whose circulation is carried out on the territory of the Russian Federation.

In accordance with it, each individual group of goods is assigned its own individual code. The purpose of this code is to simplify the identification of goods during customs procedures. Encoded data is easily and quickly processed using computer programs, thereby significantly reducing labor costs and paperwork.

The standard code consists of 10 characters, in some cases - of 14. The first 2 digits determine which specific group the product belongs to, the remaining 8 specify this information. The HS code is determined by the organization that transports products through customs; the correctness of the definition is controlled by customs representatives, since the success and speed of carrying out all necessary customs procedures largely depends on it. This code is also used to determine the nuances of taxation of certain goods.

What happens if you submit a declaration with the wrong code?

As mentioned earlier, violations committed during the declaration process are grounds for applying administrative and even criminal sanctions to those responsible. Existing rules clearly regulate the filling out of transport documentation, the responsibility for the implementation of which rests with the direct shipper or the person officially representing his interests.

Let’s assume that an entity transporting certain commercial products across the border presented FCS employees with a declaration that indicated an incorrect codifier. In addition, the accompanying documents contain insufficiently complete or incorrect data characterizing the properties and functions of the product. The result is a change in the classification of the supplied consignment without a legal basis, which entails an incorrect calculation of the customs duty, which, as a rule, changes downwards.

Violations identified as part of inspection activities are qualified by the legislator in accordance with the provisions of the administrative code. The forgery committed by the subject in question complies with the standards of Article 16.2 of the Administrative Code, which provides for a penalty in the form of a fine in the amount of up to 20 thousand rubles - if we are talking about an individual who is a declarant, and up to 200% of the amount of the unpaid fee - for organizations.

At the same time, the law reserves for customs declarants the right to independently contact border guards in order to eliminate the marks they have identified. The principle has been in effect since July 2016, and is intended to soften the control policy in relation to bona fide market participants. Voluntary admission of an error excludes the possibility of administrative liability.

What is the HS CODE for?

The TN VED code determines which documents to issue for the product - the CU TR certificate of conformity or the CU TR declaration of conformity or the SGR

You will be able to find answers to the question of what kind of certificate or declaration of conformity needs to be issued for products according to the HS code. There is a search system in the document, right-click and enter the HS code or the name of the product for which you want to find out, you must issue a GOST R certificate for it, technical regulations of the Russian Federation or technical regulations of the Customs Union, or a declaration for these profiles.

If you do not find your products in this list, then your products are not subject to mandatory certification and it is quite enough to issue a GOST R Voluntary Certificate or an Exemption Letter for Customs for your clients.

However, you need to take into account that this information is constantly updated due to the introduction of new CU TR and in any case, you better check with our experts about the relevance of the data below.

Ready to fill out the declaration. How to determine the code?

To determine the HS code, look at your product from a technical point of view. Here are the characteristics that influence the product range:

- physical parameters (size, weight, appearance);

- chemical parameters (raw materials, consistency, mass fraction of specific components);

- manufacturing technology (production method, type of processing);

- main function and method of operation.

Before turning to the classifier, study several documents to better understand the terminology:

- Chapter 3 of the EAEU Customs Code - explains the basic rules for classifying goods;

- Decision of the Council of the Eurasian Economic Commission (EEC) dated July 16, 2012 No. 54 - contains the basic rules for interpreting the Commodity Nomenclature of Foreign Economic Activity;

- Decisions on controversial categories adopted by the EEC clarify the choice for goods that fit several HS codes.

Let's try to figure it out using a simple example. Let's say your company makes decorative paving slabs and sells them in small quantities to Turkish and Greek hotels. To determine the HS code, start studying the product and ask yourself a few questions:

1. What category of product do you sell?

In its most general form, it is a concrete product. Open the classifier, press Ctrl + F and enter the word “concrete”.

First you will see group 25 and item 2517 - "Pebbles, gravel, crushed stone or crushed stone, commonly used as concrete aggregates." But you do not extract these minerals and do not produce concrete, but only use it as a raw material. This means it doesn’t fit - look further.

Heading 6810 - "Products of cement, concrete or artificial stone, whether or not reinforced." Seems to fit. Open and start exploring categories.

2. What's the function of your product?

Heading 6810 has several subheadings and subheadings. To choose the right one, study the product. You sell decorative tiles for sidewalks. This means that the first subheading is suitable - “Tiles, slabs, bricks and similar products.” If you were producing precast concrete stairs, then you would select "Other Products".

3. What do you make the product from?

Your company creates tiles from standard industrial concrete. If you added impurities from broken pumice, granulated slag or lead to it, you would choose the subheading “From lightweight concrete.” But the tiles consist of Gost concrete, so your option is “Tile; tiles, including paving slabs, etc.” This means that in column 33 of the declaration you will indicate code 6810 19 000 1.

The correctness of the code is checked using two sources: supporting documents and column 31 of the declaration. In order for customs officers to study the goods in detail, attach technical documentation to the declaration. For example, a project drawing, flowcharts, operating instructions, product data sheet and quality certificates.

In column 31, write a detailed description of the product, its physical and chemical properties, and functions. Try to use the wording from the Commodity Nomenclature of Foreign Economic Activity classifier - inspectors use it to check the codes. The more precise the wording, the higher the likelihood that there will be no questions about the codes.

Certification according to GOST R

Information about products subject to mandatory confirmation of conformity (in the form of mandatory certification and obtaining a GOST R certificate)

Information about products subject to mandatory confirmation of conformity (in the form of accepting a declaration of conformity GOST R)

Product codes

All-Russian product classifiers are Russian national standards included in the “Unified System of Classification and Coding of Technical, Economic and Social Information” and developed and implemented by departmental orders in order to obtain information about products in all sectors of the national economy and the country’s economy.

Need instant expert advice? Just call the toll-free number Or in the feedback form: Or write to us in instant messengers and get an instant response from an expert:

Product type codes:

- OKP code “All-Russian Product Classifier”,

- The OKPD code, which replaced the OKP code from 01.01.17, is OKPD 2 “All-Russian Classifier of Products by Type of Economic Activity”

- And a separate, related to the Customs Union, HS code “Commodity nomenclature of foreign economic activity”.

Since from January 1, 2021, instead of the OKP and OKPD codes, a new product classification was introduced - OKPD code 2, accordingly, in certificates of conformity where the OKP code was used, from 01/01/17 it is necessary to indicate the OKPD 2 code, and not OKP.

History of classifier development

One of the prototypes of the structure under consideration is the Harmonized System, developed by the World Trade Organization in the late 80s of the last century. The tree-type hierarchical structure, intended for describing and coding commercial products, turned out to be quite voluminous - 21 sections, 96 chapters, and over 5 thousand headings and subsections, arranged according to a logical principle, and dividing nomenclature names according to a number of objective criteria. The key differentiating factor is the presence of a unifying feature in each group, while any individual link is an independent unit, and the classification process itself is implemented in a descending manner - from the general to the specific.

Product codes used within the Harmonized System are a six-digit combination made up of Arabic numerals. The first two numbers identify the chapter, the next pair identifies the title, and the last pair identifies the subtitle, that is, the specific product name. For example, the number 190520 is used to designate ginger cookies, and 240220 is used for cigarettes containing tobacco.

Today, a similar systematization format is used in more than 180 countries around the world. If it is necessary to introduce additional detail, an increase in the code is allowed - the corresponding decision is made at the level of national legislation of states that are members of the WTO, and is usually determined by the need to track statistical indicators or establish customs tariffs. A prerequisite is to preserve the initial six characters. Starting in 2021, an updated version of the Harmonized System came into force, containing over 200 changes.

The countries of the European Union use the CN standard - a combined nomenclature, which was based on the original development of the World Trade Organization. In essence, it is an expanded version of the basic codifier, in which two more digits are added to the six-digit code, while the TARIC-Code is used for the purpose of determining customs tariffs.

The first version of the Soviet classifier, developed after joining the WTO, was a document of the USSR Customs Code of Foreign Economic Activity, also based on the Harmonized System. The collapse of the Soviet Union led to the emergence of a number of new states, which eventually jointly adopted a similar standard for the CIS, applied since 1997. The next stage in the development of international relations was the formation of the EAEU, whose participants have been using an updated unified form of codification since 2021. The basic concept remains unchanged, but the adopted innovations are distinguished by a higher degree of detail, which is determined by the use of ten-digit codes.

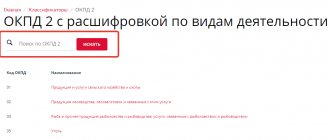

You can select the OKPD 2 code in the OKPD 2 Code Classifier: Download OKPD 2 codes for free

To certify various types of goods, HS codes and OKPD2 codes are required, and very often it is necessary to simultaneously indicate both the OKPD 2 code and the HS code, but certain difficulties arise with this, since there is no official unified system for matching HS codes to OKPD2 codes.

A lot depends on compliance of OKP with the HS code - the certification scheme, what kind of document needs to be drawn up, customs duties, VAT. For example, the price of a certificate of conformity depends on the OKP code, and on the HS code what kind of TR CU certificate of conformity or GOST R certificate is needed, or even SGR or voluntary certification.

So, let's try to answer the questions: