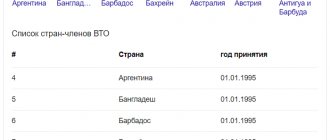

According to the register of importers, more than 170 companies supply natural wines to Russia annually. From time to time we make their ratings publicly available.

2021 are available for our clients.

Rating of Russian wine importers for the second quarter of 2021.

The prepared list of the largest importers of natural wines to Russia (HS codes 220421хххх) contains volumes in thousands of liters broken down by main countries for April-June 2021. There is also an increase/decrease in the volume of deliveries relative to the previous quarter. This year, Portugal took fifth place among the leading wine-supplying countries, surpassing Chile and Abkhazia, which were in fifth and sixth place respectively in 2020, so we included this country in the details.

Leading wine importers in the second quarter of 2021

| Importer | Volume, thousand liters | Cost, million dollars | Growth, % | Italy | Spain | France | Georgia | Portugal |

| LLC "TRADE HOUSE "LABAZ" | 6 110 | 14,83 | 66,27 | 715 | 1 531 | 568 | 1 080 | 430 |

| LLC "LUDING-TRADE" | 4 861 | 12,20 | 18,74 | 1 836 | 302 | 670 | 752 | 43 |

| MISTRAL ALCO LLC | 4 672 | 10,43 | -7,89 | 85 | 233 | 102 | 0 | 0 |

| LLC "MORO" | 4 643 | 13,34 | 12,27 | 2 396 | 139 | 473 | 757 | 388 |

| BRL LLC | 3 697 | 8,84 | 75,55 | 446 | 589 | 278 | 1 245 | 0 |

| LLC "S-IMPORTS" | 3 461 | 17,43 | 64,55 | 1 781 | 331 | 425 | 33 | 155 |

| LLC "SYNERGY IMPORT" | 3 422 | 12,07 | 23,57 | 666 | 967 | 478 | 155 | 517 |

| LLC "LOGISTICS ALTERNATIVE" | 3 238 | 7,56 | 2,52 | 416 | 295 | 509 | 873 | 172 |

| LLC "POLINI IMPORT" | 2 352 | 5,92 | -2,34 | 553 | 359 | 188 | 0 | 241 |

| JSC "TD "AROMA" | 2 340 | 9,30 | -3,28 | 761 | 360 | 226 | 79 | 258 |

| INTER-RUS LLC | 2 223 | 4,97 | 14,80 | 456 | 0 | 0 | 851 | 666 |

| ISSI SPIRITS LLC | 1 847 | 5,60 | 40,71 | 90 | 115 | 81 | 1 010 | 95 |

| LLC "BIG" | 1 785 | 7,82 | 10,17 | 380 | 83 | 197 | 595 | 11 |

| LLC "VINO ON-LINE AG" | 1 783 | 4,82 | 19,53 | 670 | 636 | 28 | 172 | 123 |

| MARINE EXPRESS LLC | 1 779 | 8,69 | 35,68 | 309 | 589 | 214 | 4 | 70 |

| LLC "LOGISTIC-TRADE" | 1 722 | 3,40 | -36,48 | 81 | 1 040 | 538 | 52 | 12 |

| JSC DIXY SOUTH | 1 575 | 3,54 | -4,65 | 663 | 586 | 210 | 0 | 0 |

| LLC "LADOGA GROUP" | 1 487 | 4,80 | 34,86 | 255 | 297 | 158 | 226 | 146 |

| LLC CDA "SOMELIER" | 1 185 | 3,94 | -9,17 | 256 | 181 | 109 | 135 | 221 |

| LLC "BRAVO TRADE" | 1 039 | 2,88 | 33,41 | 52 | 246 | 142 | 22 | 61 |

And this is what the picture of leading wine importers looked like at the beginning of 2020.

Among the top twenty suppliers of foreign wine, the first 10 largest importers generally maintained, and some even increased, supply volumes compared to the first quarter of 2021. LLC TD Labaz literally burst into the top five, increasing the volume of supplies by 2.5 times over the year. Almost all companies of the second ten importers have reduced their wine supplies by 20-30% - it is obvious that the shrinking market is being monopolized by its larger participants. The exceptions are MORO LLC with an increase of 83% and VINHALL+ LLC, which last year was not noticed among wine importers, but has now imported more than 1 million liters, mainly of Georgian and Italian wines.

The diagram shows the geographical structure of supplies of the five leading importers.

More detailed data is given in the table, which shows the volume of imports of companies by the main countries supplying wine to Russia: Italy, Spain, France, Georgia, Abkhazia.

In this way, the specialization of each importer can be assessed. The increase reflects the change in the physical volume of importer supplies (in liters) compared to the first quarter of 2021. Indicators of the 20 leading wine importers for the first quarter of 2021.

| Importer | Volume, thousand liters | Cost, million dollars | Growth, % | Italy | Spain | France | Georgia | Abkhazia |

| MISTRAL ALCO LLC | 5 053 | 12,11 | 9,95 | 69 | 300 | 102 | 0 | 3 429 |

| LLC "LUDING-TRADE" | 4 077 | 9,17 | -2,02 | 771 | 365 | 1 055 | 480 | 0 |

| LLC "LOGISTIC-TRADE" | 3 557 | 9,35 | 2,30 | 441 | 953 | 868 | 1 270 | 0 |

| LLC "S-IMPORTS" | 2 698 | 14,29 | -3,04 | 954 | 434 | 326 | 53 | 0 |

| LLC "TRADE HOUSE "LABAZ" | 2 478 | 5,18 | 154,89 | 132 | 794 | 167 | 267 | 0 |

| JSC "TD "AROMA" | 1 907 | 7,53 | 11,54 | 516 | 437 | 243 | 35 | 0 |

| BRL LLC | 1 889 | 4,56 | 42,43 | 325 | 392 | 259 | 439 | 0 |

| MARINE EXPRESS LLC | 1 540 | 5,22 | 49,44 | 235 | 617 | 194 | 0 | 0 |

| LLC "LADOGA GROUP" | 1 512 | 4,61 | 53,78 | 241 | 329 | 213 | 197 | 0 |

| WINE STYLE LLC | 1 377 | 4,07 | -24,36 | 109 | 341 | 193 | 647 | 0 |

| LLC "SYNERGY IMPORT" | 1 324 | 4,75 | -15,91 | 210 | 555 | 158 | 120 | 0 |

| LLC "POLINI IMPORT" | 1 286 | 3,82 | -38,41 | 554 | 127 | 127 | 0 | 0 |

| LLC "BIG" | 1 175 | 4,90 | -25,73 | 296 | 19 | 107 | 363 | 0 |

| LLC "LOGISTICS ALTERNATIVE" | 1 142 | 2,71 | -44,15 | 219 | 22 | 63 | 386 | 0 |

| LLC "MORO" | 1 095 | 3,07 | 83,34 | 519 | 47 | 73 | 92 | 0 |

| LLC "WINHALL+" | 1 003 | 2,43 | NULL | 207 | 11 | 64 | 317 | 0 |

| LAVINA IMPORT LLC | 944 | 2,35 | -6,96 | 500 | 158 | 114 | 111 | 0 |

| LLC CDA "SOMELIER" | 924 | 2,94 | -37,81 | 259 | 112 | 53 | 116 | 0 |

| LLC "VINO ON-LINE AG" | 907 | 2,52 | -35,13 | 279 | 313 | 16 | 0 | 0 |

| LLC "UTA" | 874 | 2,02 | 32,43 | 202 | 133 | 129 | 169 | 0 |

Structure of wine imports to Russia

In accordance with customs statistics, foreign trade entities imported wine and wine products worth $165.35 million from abroad during the period from January 1, 2020 to March 31, 2020. The total volume of imported products amounted to 52.48 million liters.

During the first quarter of 2021, importers increased supply volumes. The following distribution is demonstrated by month:

- January 2021 – 13.76 million liters in the amount of $42.9 million;

- February 2021 – 18.14 million liters. in the amount of $58.39 million;

- March 2021 – 20.58 million liters for the amount of $64.05 million.

If we consider the structure of imports, the largest exporting countries for the period under review were Italy, France and Spain. The volumes of supplies from these countries are as follows:

- Italy – 10.35 million liters imported. wines (19.73% of the total) worth $36.71 million (22.2%).

- France – 6.58 million liters imported. (12.55% of the total volume) in the amount of $28.26 million (17.09%).

- Spain – 9.95 million liters imported. (18.97% of the total volume) in the amount of $25.12 million (15.19%).

Bottoms Up

Russia is not the wine-richest country in the world: although it ranks 9th in terms of population, we are not even among the world’s top twenty in terms of per capita wine consumption.

The average Russian drinks, according to Rosstat, about 57 liters of beer per year, 6.6 liters of various 40-proof alcohol and only 4 liters of wine and champagne. According to official statistics, most of the wine sold in the country is produced here – 66%. True, up to a third of this volume is made from foreign wine materials, which in Russia are only mixed and bottled. Therefore, to be honest, domestic and imported wine bottles are sold approximately equally. But as for the trends in the consumption of domestic and imported wine, they are multidirectional. Retail sales of red, white, as well as fortified and sparkling wine are falling: in 2021 in Russia, according to Rosalkogolregulirovanie, over 800 million liters of wine were sold, and in 2021 - only 657 million. However, this is not the fault of imported drinks: in these years 174 million and 226 million liters of wine were brought into the country, respectively. So, in general, becoming sober, Russians do not refuse foreign wines, but, on the contrary, buy them more and more willingly.

Almost every fifth bottle of imported wine came to us from Spain. The times when more than half of imports came from Moldova and Georgia are long gone. True, the Spaniards are leading only in terms of physical volume, but in terms of monetary indicators, Italian winemakers are ahead: in 2021, they supplied us with products worth more than $160 million (France is in 2nd place with $125 million). At the same time, the average price of 1 liter of imported wine at the end of last year reached $3.2. Let us emphasize: this is the customs price, which is noticeably lower than the retail price.

Quarterly dynamics since January 2021

If we consider the dynamics in the period from 01/01/2019 to 03/31/2020, then in the 1st quarter of 2021 there was a maximum decline in wine imports. The highest figures were recorded in the 4th quarter of 2021.

Dynamics from 01/01/2019 to 03/31/2020

| Period | Cart volume | Price | ||

| Volume in liters | Share in total volume | Cost in $ | Share in total volume, % | |

| 1 sq. 2019 | 56.4 million | 16,7 % | 172.95 million | 16,7 % |

| 2 sq. 2019 | 61.83 million | 18,4 % | 189.52 million | 18,3 % |

| 3 sq. 2019 | 74.25 million | 22 % | 221.7 million | 21,3 % |

| 4 sq. 2019 | 92.63 million | 27,4 % | 288.12 million | 27,8 % |

| 1 sq. 2020 | 52.48 million | 15,5 % | 165.35 million | 15,9 % |

| In just 5 blocks | 337.6 million | 100 % | 1037.64 million | 100% |

Dynamics of wine imports from leading exporting countries by volume from 01/01/2019 to 03/31/2020.

| A country | In just 5 blocks | 1 sq. 2019 | 2 sq. 2019 | 3 sq. 2019 | 4 sq. 2019 | 1 sq. 2020 | ||||||

| million l. | share, % | million l. | share, % | million l. | share, % | million l. | share, % | million l. | share, % | million l. | share, % | |

| Italy | 69,18 | 20,5 | 10,54 | 18,7 | 12,82 | 20,7 | 15,1 | 20,9 | 20,36 | 22 | 10,36 | 19,7 |

| France | 38,05 | 11,3 | 6,71 | 11,9 | 6,32 | 10,2 | 8,23 | 11,1 | 10,21 | 11 | 6,58 | 12,5 |

| Spain | 63,85 | 18,9 | 10,64 | 18,9 | 12,06 | 19,5 | 14,31 | 19,3 | 16,89 | 18,2 | 9,95 | 19 |

| Georgia | 50,79 | 15 | 10,04 | 17,8 | 8,74 | 14,1 | 9,69 | 13,1 | 14,99 | 16,2 | 7,33 | 14 |

Dynamics of wine imports from leading exporting countries by value from 01/01/2019 to 03/31/2020.

| A country | In just 5 blocks | 1 sq. 2019 | 2 sq. 2019 | 3 sq. 2019 | 4 sq. 2019 | 1 sq. 2020 | ||||||

| million $ | share, % | million $ | share, % | million $ | share, % | million $ | share, % | million $ | share, % | million $ | share, % | |

| Italy | 242,62 | 23,4 | 38,95 | 22,5 | 45,36 | 23,9 | 51,32 | 23,1 | 70,29 | 24,4 | 36,7 | 22,2 |

| France | 158,29 | 15,3 | 27,34 | 15,8 | 27,3 | 14,4 | 32,92 | 14,8 | 42,47 | 14,7 | 28,26 | 17,1 |

| Spain | 154,87 | 14,9 | 25,05 | 14,5 | 29,26 | 15,4 | 33,77 | 15,2 | 41,67 | 14,5 | 25,12 | 15,2 |

| Georgia | 161,44 | 15,56 | 31,58 | 18,3 | 27,82 | 14,7 | 29,86 | 13,5 | 48,99 | 17 | 23,19 | 14 |

Results of the 1st quarter of 2021

The obtained statistics clearly demonstrate the increase in wine imports throughout 2021, both in value and quantity terms, and a sharp decrease in volumes in the 1st quarter of 2020. The drop in wine import volumes by value was 4.6% compared to the first quarter of 2021. Compared to the 4th quarter of 2021, the best in 15 months, the drop was 42.6%. This sharp deterioration in indicators is explained not only by the traditional “post-New Year” decrease in demand, but also by a general decline in business activity, even before the start of the “coronavirus” quarantine in Russia.

The world in red and white

From general figures, let's move on to the pressing: how not to make a mistake when buying imported wine? You can find good wine in the supermarket, but the storage conditions there are not ideal. “If you still have to buy wine in a regular store, give preference to young vintages. In supermarkets there are no conditions for proper storage of wine, and the less time it has been there, the better,” advises sommelier, brand ambassador of the L-Wine online showcase Sergei Antonov.

To get certain guarantees, it is better to choose wines from large wine importers, adds Antonov: “The chances of stumbling upon low-quality wine among the products of trusted suppliers are much less, since large companies are interested in customer loyalty and their own reputation.”

The common rule “the more expensive, the better,” which many are accustomed to following, does not work with wine. However, experts agree that a bottle of good wine cannot cost less than 500 rubles. “Today, good quality European wine costs 800-1000 rubles in stores, from 1500-2500 rubles you can find really interesting samples, and good wines from the New World can be bought for 600-800 rubles,” says Antonov. Anatoly Korneev, Vice President of the Simple Group of Companies, defines the same framework: “My recommendation: if you want to drink well, go for 500 rubles up. You're much more likely to get a quality product than down there. There may be a quality product there, but there is no guarantee.”

It is difficult to determine whether a wine is of high quality by looking at the label, but there are several important details. First, there are “Protected Designation of Origin” wines. By purchasing them, you receive certain guarantees. Secondly, the label should not be torn or peeled off. Thirdly, use EGAIS and check the excise stamp online.

Winemakers warned wine importers in Russia about a 25% rise in prices

Suppliers have notified major wine importers and retail chains of their intention to increase prices for their products. They associated a 20-25% increase in prices with a poor grape harvest, especially in Italy and France, and increased logistics and production costs, RBC reports, citing Russian importers and correspondence with winemakers from abroad.

According to Alexander Lipilin, executive director of alcohol distributor Fort, wine producers from a number of wine-producing regions at the beginning of purchasing negotiations for next year announced an increase in the price of wine by 20-25% in dollars and euros. Almost all suppliers, including Italian and French, have notified a minimum price increase of 10%, said a representative of the wine trading company MBG Wine. Luding Group Executive Director Ernest Khachaturyan announced the expected increase in selling prices.

Material on the topic

The Lenta and Verny retail chains also received notifications about the upcoming increase in wine prices. One of the wine suppliers to Russia indicates in his letter that the increase in prices for raw materials in wine-growing regions amounted to up to 20%. The regions of France - Champagne and Burgundy, Italy - Friuli and Veneto, and New Zealand - Marlborough - suffered the most from “critically poor yields,” the letter notes. In some of them, the supply of grapes fell by 20-30%.

Advertising on Forbes

Wine suppliers justify the rise in prices by the rise in cost of consumables. Prices for cork, capsules and screw caps increased by 60%, for labels by 50%, for packaging (boxes and dividers) by 80%, and for glass containers by 20%, the Verny retailer explained. Within Russia, road transportation costs rose by 30%, and on European routes the cost of container logistics tripled.

Material on the topic

The International Organization for Viticulture and Winemaking predicted in the fall that by the end of the year, global wine production would decrease by 4%, to approximately 250 million hectoliters. This is 7% less than the average production over the past 20 years. The organization's experts assessed the forecast level of wine production as extremely low. The historical minimum production was reached four years ago - then 248 million hectoliters of wine were produced in the world.

Experts expect that production will decline the most - by 13% year on year, to 145 million hectoliters - in European countries. Italy, Spain and France account for 45% of world production; these same countries in a different order - Italy, France, Spain - are the largest, according to customs statistics, suppliers of wine to Russia. In New Zealand, the grape harvest was damaged by late spring frosts.

Material on the topic

Verny clarified that suppliers are proposing to raise purchase prices for wine by 3-20%, but the chain has not yet agreed to their terms. The retailer believes that suppliers are trying to play to their advantage on the increased demand for alcohol on the eve of the New Year holidays. A Lenta representative said that notifications of price increases are considered on an individual basis, and negotiations are underway with suppliers to avoid sharp price hikes.

Importers also negotiate with suppliers. According to Lipilin, there is progress in the negotiations, because if the cost of wine increases to the proposed levels, winemakers’ products will move into a more expensive category and its sales will decrease. “Thus, in negotiations we are gradually coming to a mutually acceptable price,” the publication’s interlocutor said. According to Lipilin’s forecast, the increase in product costs by the spring of 2022 will be no more than 10–12%. Khachaturyan expects that the increase in selling prices for imported products for the company’s partners will be no more than 5–10%.

Three myths about wine

Myth 1: The older the wine, the more noble its taste

The viability of wine depends on many factors: soil, geography, storage conditions. Aging of wine is the breakdown of complex molecules into new ones. As a result, wine changes its taste over the years. If the taste becomes more interesting, then the wine has the potential to age. But such people are in the minority. The potential is higher for red wines that have been kept in a barrel for a long time - they have more complex molecules that can break down “correctly”. Good wines age for 20–30 years, but after that their taste also deteriorates. For example, one of the five most expensive wines sold at auctions is Château Lafite-Rothschild from the 1787 vintage - it was sold in 1985 in London for $160 thousand. As it turned out, over the 200 years that had passed by the time of purchase, the wine had deteriorated. But the buyer was still satisfied - the wine belonged to US President Thomas Jefferson, and his initials are on the bottle.

Myth 2: Cork plug is better than screw plug

Sergey Antonov, brand ambassador of the L-Wine online showcase: “A screw cap is not at all a sign of cheapness. It is more modern, guarantees 100% tightness of the wine, perfectly preserves freshness, expressive taste and minimizes possible wine defects that happen with a classic cork stopper. The only significant difference is that vint wines are not intended for long-term storage and aging in cellars; they must be drunk young.”

Wine and wine materials in the Commodity Nomenclature of Foreign Economic Activity

To import wine, you must complete a number of steps before the cargo crosses the customs border of the Russian Federation. First you need to collect a package of documents and classify products according to the Commodity Nomenclature of Foreign Economic Activity.

ATTENTION! We work only with legal entities.

Natural grape wines, including fortified ones, and grape must are included in the HS 2204 group. Its composition can be viewed in more detail directly in the foreign economic activity product nomenclature. The group includes many items, taking into account the variety and alcohol content. The largest of them:

- sparkling wines (wines in closed containers with an excess pressure of at least 3 bar at a temperature of 20 °C) - belong to group 2204 1;

- other wines, as well as grape must with the addition of alcohol - to group 2204 2;

- other grape must - to group 2204 3.

Vermouths and grape wines with the addition of plant and artificial flavors belong to another group of the HS - 2205.

Inexperienced declarants do not always know how must differs from wine material, but the code in the Commodity Nomenclature for Foreign Economic Activity is different for these products. Wine material is a broad concept. It is obtained after the primary stage of grape processing, after which it is processed and aged a second time. In this case, table wine material is obtained, which can be consumed as is or used for the production of other alcoholic beverages.

Wort, in fact, is also a wine material; it is obtained as a result of alcoholic fermentation of grapes. It is a product that has not been subjected to significant further processing, namely no clarification, filtration, temperature treatment, assembly, aging, blending, secondary fermentation.

According to the commodity nomenclature of foreign trade activities, the rate of customs duty on products should be determined. The customs duty rate for wines classified under codes 2204 1..., 2204 2... is 12.5%. Other grape must, which belongs to group 2204 3, is cleared through customs at a customs rate of 5%. For wines with the addition of plant and aromatic substances, the customs duty is 10%. The value added tax rate is always constant – 20%. The duty of the declarant is to calculate the amount of customs duties and provide the customs office with a receipt for their payment.

Excise products

The declarant is obliged, in addition to calculating customs duties, for alcoholic products subject to marking with excise stamps (Federal Law of the Russian Federation of November 22, 1995 N 171-FZ “On state regulation of the production and circulation of ethyl alcohol, alcoholic and alcohol-containing products and on limiting consumption (drinking) ) alcoholic products", before importing them into the territory of the Russian Federation, stick excise stamps and enter information in the Unified State Automated Information System. The procedure for obtaining excise stamps is regulated by Order of the Federal Customs Service of Russia dated October 7, 2010 N 1849 "On approval of the rules for the acquisition of excise stamps for labeling alcoholic products and control over their use". This action is completed before the cargo crosses the customs territory of the Russian Federation. An application for the issuance of excise stamps is submitted 3 months before delivery. They cannot be taken “in reserve”, but only in quantities strictly corresponding to the quantity of consumer packaging under the foreign trade contract. Stamps on finished products are applied by the manufacturer, so they need to be transferred to production.

The beginning of 2021 was a turning point in the customs clearance of wine materials and even grapes. On January 1, amendments to Chapter 22 of the Tax Code introduced by Law No. 326-FZ dated September 29, 2019, come into force. According to the amendments, excise duty now covers wine materials, grape and fruit must, as well as domestic and imported grapes used in the production of wine materials, grape must, champagne and wines. The amendments were introduced due to numerous attempts to transport imported wine under the guise of raw materials without paying excise duties.

In addition, in 2021, excise tax rates on wine will be increased, and an excise tax rate will be introduced on wine drinks that are produced without the addition of alcohol. The latter is set at the level of excise taxes for sparkling wines.

According to Letter 01-11/19309 dated 04/06/2020 of the Federal Customs Service of Russia (Excise tax rates on imported excisable goods), excise tax rates on wine products are as follows:

- 30 rub/l – grapes used in wine production;

- 31 rub/l - wine materials, grape must, fruit must;

- 40 rub/l – sparkling wines (champagne);

- 544 rubles/l.sp - alcohol-containing products;

- 31 rub/l - wines, fruit wines;

- 40 rub/l - wine drinks without the addition of ethyl alcohol;

- 544 rubles/l.sp - alcoholic beverages with an alcohol content of more than 9%;

- 435 rubles/l.sp - alcoholic beverages with a strength of more than 0.5%.

In 2021 and 2022, excise tax rates are planned to increase: for grapes used in production to 31 and 32 rubles per ton, respectively, for wine materials, grape must and fruit must - to 32 and 33 rubles, respectively, for wines and fruit wines - up to 32 and 33 rubles, respectively, for sparkling wines - up to 41 and 43 rubles, for wine drinks made without the addition of ethyl alcohol - up to 41 and 43 rubles.

The excise tax amount may be reduced by deduction. If the products are sold, then excise tax amounts paid when importing wine materials, grapes, fruit and grape must into the Russian Federation are subject to deduction. In this case, it is necessary to provide documents according to the list specified in clause 19 of Article 201 of the Tax Code of the Russian Federation.

At which customs post should I register?

Customs clearance of excisable products is carried out only by a specialized customs post.

At the moment, customs declaration and release (customs operations in accordance with Chapters 17 and 18 of the EAEU Customs Code) of wines (alcohol products) are carried out exclusively at the customs post of the Excise specialized customs post (electronic declaration center) of the Central Excise Customs (code 10009100) Carrying out customs operations when import into the Russian Federation, other than customs operations of declaration and release in relation to wines, can be carried out at any posts that have general competence in relation to goods: storage of goods, inspection, inspection, etc.

However, for goods such as wines originating from Moldova, Georgia, as well as the carbonated wine drink “Bosca Anniversary” (Bosca Anniversary), produced by JSC “Boslita & Co” in Lithuania, delivery of goods is carried out exclusively to the customs posts of the Central Excise Customs listed in order of the Ministry of Finance of Russia dated December 23, 2021 245n “On the competence of customs authorities to carry out certain customs operations in relation to goods.”

Also, when delivering wines when imported into the Russian Federation, it is necessary to take into account the possibility of a temporary storage warehouse (including concluding an agreement with a temporary storage warehouse) to store alcoholic products - wines. To store such products, the temporary storage warehouse must have an appropriate license issued by Rosalkogolregulirovanie.

When exporting wines from the Russian Federation (export), the above requirements do not apply.

Transportation of wine

When transporting wine, it is important to maintain optimal temperature conditions, so wine products are transported in isothermal vans or refrigerators, in which the temperature is maintained at +12°C +/- 2°C. In addition, the wine must be protected from sunlight. Ideally it is transported in the dark. They also try to plan the route in such a way as to avoid strong shaking and vibration. For elite wines, the optimal mode of transport has been and remains the plane. Non-elite varieties can be transported by various modes of transport. Moreover, wines are not always transported in glass bottles. Flexitanks with a capacity of 10-28 thousand liters and heat-insulating tanks are often used as containers. If wine is still transported in bottles, they must be made of tinted glass. When transporting in bulk, they are placed in a horizontal position so that the plug is in contact with the liquid. This way oxidation is avoided. Bottles must be packed tightly into transport packaging. The box with bottles is secured with special straps. In ordinary trucks, wine can only be transported over short distances and only if the ambient temperature does not differ significantly from the recommended one.